Plant Services 2019 Workforce Survey: What have you done for me lately?

What do your plant’s workers want?

It’s a simple question (has your organization asked it?) but the answers are complex—and what’s valued most varies somewhat based on the age of the person being asked. Plant Services’ 2019 Workforce Survey asked workers in manufacturing and industrial production organizations across the country what would encourage them to stay with their current employer and what could prompt them to leave. It asked about their confidence in their job prospects and about what they believe their organization could be doing better to attract and retain talent.

Some of the differences in responses by generation were stark. But still common themes emerged: Namely, that in a strong job market for skilled manufacturing talent, workers are keenly interested in career development opportunities and are looking for more than money to stay engaged in their organization.

More than 200 individuals participated in this year’s workforce survey, which was conducted online this summer. A plurality of respondents identified as Baby Boomers (born 1946–1964); more than one-third identified as Gen X (1965–1980); and 13% were Millennials (1981–2000). The top roles reflected among the respondent base were department manager, maintenance/reliability staff, and maintenance/reliability supervisor, although a wide range of roles, from controls/systems engineer to analytics specialist to corporate executive, was represented overall.

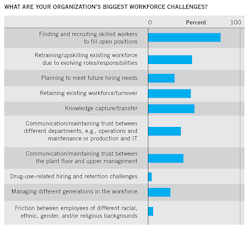

As was the case in 2018, finding skilled workers to fill open positions ranked as the No. 1 workforce challenge that respondents said their organization was facing (see Figure 1)—and it may be an even more-pressing issue today. Eighty-one percent of respondents this year said finding talent to fill open roles is a leading workforce challenge at their company, versus 71% who said the same last year.

Next highest on the list was knowledge capture/transfer (51%), followed by retraining/upskilling workers due to evolving worker roles/responsibilities (49%) and retaining the existing workforce (47%).

Results of the 2019 Plant Services Workforce Survey jibe with national data on manufacturing’s evolving labor needs and opportunities. In 2018, according to the Bureau of Labor Statistics, U.S. manufacturers added 264,000 new jobs—the most since 1988. Manufacturing as a share of the overall U.S. workforce rose for the first time since 1984, MarketWatch reporter Steve Goldstein noted in January.

Still, the changing requirements of manufacturing roles today—being able to use new, online machine monitoring technologies or robotics-assisted tools, for example—in combination with a tide of baby boomer retirements means there’s a mismatch between demand for and supply of skilled manufacturing talent. The 2018 Manufacturing Skills Gap Study from Deloitte and the Manufacturing Institute found that the skills gap could leave 2.4 million manufacturing jobs unfilled by 2028, at a potential U.S. economic impact of $2.5 trillion.

Against this backdrop, there is this: In a recent poll commissioned by the National Association of Manufacturers, only 27% of parents said they would encourage their children to pursue a career in manufacturing. And 75% of Americans of all ages who participated in a survey conducted by manufacturing software provider Leading2Lean this spring said that no counselor or mentor had ever suggested trade or vocational school to them as a career path.

It may be no surprise, then, that Plant Services’ workforce survey respondents are generally confident in their job prospects. Eighty-six percent of respondents said they believe that their job will exist in five years, and 75% indicated they’re at least as confident in their job prospects as they were in 2015, when we first asked the question.

With an awareness both that filling open positions is a leading challenge for their organization and that their own skills are in demand, what do manufacturing workers see as the answer to talent needs at their company? In two words: career development.

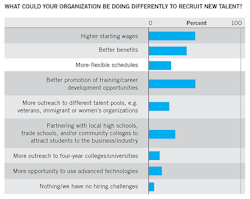

Better promotion of training and career development opportunities within the organization was the No. 1 thing that survey respondents said their company could be doing differently to better recruit new talent (see Figure 2). Getting out the word on these opportunities edged out even offering higher starting wages when it came to tactics that employees believe could support recruitment efforts.

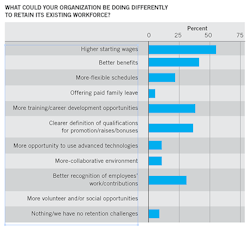

And with respect to retaining the existing workforce, offering more training and career development opportunities ranked third (38%), behind higher wages (55%) and better benefits (41%) in terms of incentives that respondents believe would help keep workers on the job at their current organization (see Figure 3). Ranking right behind career advancement opportunities? A clearer definition of qualifications for promotion/raises/bonuses (37%).

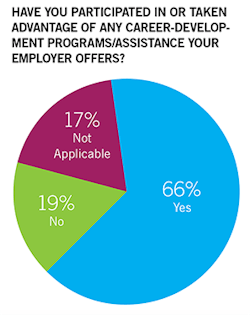

Nearly two-thirds of respondents (65%, the same share as in 2018) said they have taken advantage of career development opportunities that their employer offers. (One in six responded “not applicable,” see Figure 4.) Among respondents who said they have seized these opportunities, a definitive majority has found them worthwhile: 73% said they believe that their participation is helping them advance on their career goals.

Asked about specific development opportunities that their organization offers, employees indicated that traditional in-house training to help workers advance in their career dominates the landscape: 64% said their employer offers such training. Not quite half (47%) said their employer offers deferred tuition or reimbursement of college tuition. Sponsorship of participation in outside workshops or training programs (38%) and sponsorship of participation in industry conferences (36%) followed (see Figure 5).

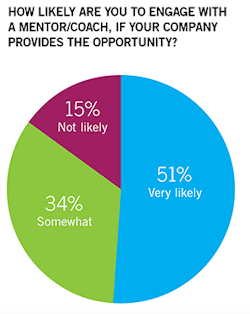

Just 20% of respondents said their company offers a formal mentorship program. However, asked how likely they would be to engage with a mentor or coach if given the opportunity, 51% indicated they would be very likely to do so. More than one-third (34%) said they would be somewhat likely to do so; only 15% said they likely would not engage (see Figure 6).

Putting their money where their mouth is

As manufacturers across the country voice concerns about finding the talent they need to keep production moving and keep their company growing, to what extent are they looking in the mirror to reflect on how they might better support workforce development? Keith Barr, president and CEO of Leading2Lean, sees opportunity for manufacturers to be more engaged in workforce development at the local level.

“I think ponying up a little bit” can have a big impact when it comes to shoring up the local talent pipeline and working to become a more-engaged member of the community, Barr says. “Scholarship programs are really valuable,” he adds. “I think there’s a significant population of our young people whose parents can’t afford to send them to some of these (trade) schools; in some cases (the students) are retraining or are young adults with families … Scholarship programs I think have a huge value, encouraging people to invest in the skilled trades.” Leading2Lean, for its part, offers two scholarships, Barr notes.

In addition, when it comes to self-promotion, manufacturers would do well to talk about not only what they produce but also the kinds of careers and working environment they offer, Barr says. “Shifting the advertising from branding the product ... to focus a little more on recruitment,” offers Barr, is important in reaching especially younger prospective workers looking not only for a decent paycheck but also where a job can take them and the impact they can have. “Things like transparency and access to information and the ability to influence or solve big problems are great motivators to Gen Z,” he says.

For all of the growing national discussion about bolstering support for trade schools and community college-based manufacturing training programs, Plant Services workforce survey respondents indicate that four-year colleges and universities are the largest target of their organization’s education outreach efforts. Forty-eight percent of respondents said their company has engaged four-year schools in the quest for new talent; 30% said their company has engaged with two-year colleges. Around one in five said their organization has worked with adult education/retraining organizations (22%) or high schools (21%) to source and develop potential talent. Notably, 31% said their organization didn’t work with educational institutions or workforce development organizations at any level or that they weren’t aware of such efforts.

Andrea White, global maintenance excellence manager at packaging products and services specialist Sonoco, based in Hartsville, SC, said her company’s work with the Apprenticeship Carolina network has been invaluable in helping Sonoco establish a successful apprenticeship program. That’s in part because the state-based network facilitated connections between Sonoco and technical colleges that look to local manufacturers to inform their curriculum development, White says. (See White’s Big Picture Interview, “Make apprenticeships a triple win.”)

“What we have found through this process is we have got a lot of excellent technical school systems across this country that we have not tapped into, and they are clamoring for companies to utilize them as a resource,” she says. “They’re bending over backward to help with the training that is needed both with new folks and for folks who have been in their roles for quite a while.”

Barr’s and White’s message for manufacturers: In the competition for talent, you can’t win from the sidelines.

What workers want (and how that varies by age)

The good news: 74% of survey respondents said they would be happy to remain at their current organization in two years. The less-great news: That’s down slightly from the 78% who said the same in 2018. In addition, Plant Services this year parsed out survey responses by generation, and among Millennial respondents—those born between 1981 and 2000—that figure stands at 65%.

Asked to speculate on leading reasons they might voluntarily depart their organization in the next two years, an opportunity elsewhere with better pay or benefits (71%) ranked as the top response overall, ahead of an opportunity elsewhere with new or more-attractive job responsibilities (50%), an opportunity elsewhere with better career advancement potential (45%), and an opportunity to relocate (23%).

However, for the smaller base of Millennial respondents, greener pastures were defined more by advancement opportunity than by anything else: 80% said a role elsewhere with better career advancement potential would be a likely reason for their departure, compared with 70% who said the same of an opportunity with better pay or benefits or an opportunity with more-interesting job responsibilities.

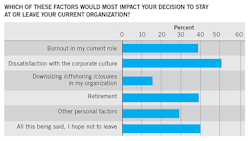

Some of the starkest differences in responses across age groups were in reply to a question about factors that would impact respondents’ decision to stay with or leave their organization. Overall, “dissatisfaction with the corporate culture” ranked as the leading factor (cited by 51%) that respondents said would influence their stay-or-go decision. Retirement (40%) and burnout (39%) followed; both of these ranked well ahead of “other personal factors” (30%) or concerns about downsizing/offshoring/plant closures (16%).

By generation, though, the breakdown was as follows:

- 80% of Millennial respondents said dissatisfaction with the corporate culture would be a top factor affecting their stay-or-go decisions.

- 43% of Gen X respondents said the same.

- 51% of Baby Boomer respondents said the same.

As Gen Xers prepare to succeed Baby Boomers in senior leadership roles and Millennials move up the ladder, as well, organizations may find it worthwhile to consider whether differences exist in Gen Xers’ and Millennials’ leadership strategies and priorities and, if so, how these can be managed to minimize turnover during transitions.

“Millennials are demanding improved workplace cultures and are voting with their feet,” says Cheryl Thompson, a former 30-year employee with Ford Motor Co. and the founder of CADIA, the Center for Automotive Diversity, Inclusion and Advancement. Thompson also is an Influential Women in Manufacturing 2019 honoree. “They are not accepting poor leadership behavior that previous generations did,” Thompson says. “We are shifting from the command-and-control leadership style to a coaching style. Millennials are now becoming leaders and tend to lead in a more collaborative and inclusive way.”

Also of note: Millennials were more likely than older respondents to view burnout as a potential issue. 55% of Millennials, vs. 39% of respondents overall, indicated burnout would be a top influence on their stay-or-go decisions. On the bright side for manufacturers, Millennial survey respondents had a more-positive view than did their older colleagues of new asset management technologies in use on the job. Half of the smaller base of Millennial respondents said they believe new condition monitoring and asset management technologies are making their job easier and/or improving their team’s efficiency, vs. 41% of respondents overall who said so.

Taken together, the results of the Plant Services 2019 Workforce Survey suggest a profile of a manufacturing workforce that is, on the whole, confident about its job prospects, with individual workers eager to seize opportunities for skills development and advance their career in the industry. The extent to which manufacturers themselves embrace this, work to actively engage employees throughout their tenure, and are able to “sell” both prospective and current employees on not just the company’s products but also the potential of a rewarding career with the company may have a large impact on whether organizations are able to meet their existing and future workforce needs.