Calculate the life cycle cost of your compressed air system

Life cycle cost (LCC) calculations are used as a tool to evaluate the different investment options for equipment. Included in LCC calculations are the product’s combined costs during a specific period – usually 10 years – which includes capital costs, operating costs, and service and maintenance costs.

The LCC calculation is often implemented based on a planned installation, but is more commonly performed on a working installation. The working installation may have several older air compressors or compressed air equipment that is no longer capable of operating efficiently. The LCC calculation defines the requirement level for the new installation.

However, it is right to point out that a LCC calculation is often only a qualified guess with regard to future costs, and is limited because it is based on today’s knowledge of an installation’s condition and energy prices. Neither does it bear in mind "soft" values that can be just as important such as production and overall plant safety, nor subsequent costs related to these values.

Factors Involved in LCC Calculations

To produce an acceptable LCC calculation, it requires knowledge and experience with compressed air installations. For the best result, the LCC calculation should be made in consultation with the compressed air sales consultant.

Different investment options affect the following factors and are central issues to consider during LCC calculations and subsequent equipment recommendations:

- Production quality;

- Production safety;

- The potential for subsequent investments;

- Maintenance of production machines and the distribution network;

- Environment;

- Final product quality; and

- Risk assessment for downtime and rejections.

An expression that must not be forgotten in this context is the life cycle profit (LCP). The LCP represents the earnings that can be made through initiatives such as energy recovery and reduced product rejections. Also affecting the LCP are energy rebate programs; many utility companies offer substantial rebates for thousands of dollars toward the purchase of new, more energy efficient equipment.

When assessing service and maintenance costs you must also consider the equipment’s expected condition after the calculation period has passed (i.e., whether it should be seen as consumed or restored to its original condition). Most LCC calculations cover 10 years, and technology, especially with regard to energy savings, is advancing at a rapid pace. At the end of the equipment’s life cycle, the 10-year-old equipment will most likely be surpassed by a more energy efficient product.

Furthermore, the calculation model must be adapted to the type of compressor. Consider an installation that uses oil-injected rotary screw compressors with filtration clean-up instead of oil-free compressors that should have been installed initially, such as in food processing plants. The type of compressor best suited for the installation should always be considered in a LCC calculation.

This is especially true in critical manufacturing applications where liability of product contamination is always present. Although initial cost may be higher for oil-free air compressors, the cost of added filtration, oil-injected compressor maintenance—servicing of large oil sumps with regard to oil changes—and the increased chance of product contamination adds up. Plus, there is an increased risk of added costs through liability settlements, unexpected downtime and a damaged reputation, should oil come in contact with the end product.

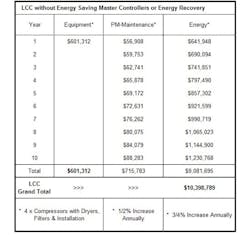

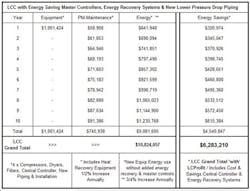

The example below illustrates a typical economic evaluation of a compressor installation, and most importantly, shows the difference between an installation with energy recovery and without energy recovery.

Figure 1. LCC comparison between an installation without energy recovery (left), and a system

with energy recovery (right).

Energy audits reveal opportunities for new equipment

The following scenario illustrates how an energy audit can result in excellent savings, especially when older and inefficient compressed air equipment represents the majority of the current installation. It is a reminder of how important it is to manage the complete plant air system, while helping demonstrate the life cycle profit (LCP) when energy efficient products are installed and energy recovery systems are included in the new product scope.

A complete LCC analysis should include, but is not limited to, the following:

- Load profile;

- Unloaded energy costs;

- Energy recovery;

- Pressure drops across equipment and through the piping system;

- Demand charges;

- Dryer energy costs;

- Energy costs to operate auxiliary equipment such as cooling towers, chillers, air conditioners and duct fans;

- System pressure set-points;

- Load/unload cycle time;

- Bleed-down losses;

- Non-production operation;

- Artificial demand;

- Air leak losses; and

- Other factors the project engineer recommends.

Figure 2 represents a facility with older and energy inefficient equipment totaling six air compressors, dryers (not shown), an old piping system throughout and higher operating pressure than actually required. Two example LCC calculation charts for this system have been prepared, and are shown in Figures 3 and 4.

Figure 2. Schematic of example facility with older and energy-inefficient compressed air equipment.

Figure 3. LCC calculation chart for new compressed air system without energy recovery.

Figure 3 is a simple 10-year LCC calculation with no additional energy savings master controls or energy recovery equipment. In contrast, Figure 4 shows the same LCC calculation, now with energy savings equipment taken into consideration. Although the initial equipment cost is higher than in the calculation without energy recovery, the energy savings difference is significant. The savings shown is $4,540,847 over 10 years. This will be considered life cycle profit because it significantly lowers the 10-year LCC energy cost calculation. The other positive factor in this scenario is the initial savings for the first two years. Savings of $1,189,645 yields a payback and ROI in less than two years (1.7 years).

Figure 4. LCC calculation chart for new compressed air system with calculated return on investment (ROI), energy efficiency improvements and energy recovery values.

Conclusion

It is always recommended to have a plant air audit performed before any new equipment purchase is considered. Many times the actual compressed air requirement has changed over the years and in most cases less air can be consumed due to production area reductions or even newer, more energy efficient production equipment. Also review the air quality requirement when considering the type of compressors for the new installation. Do you need oil-free air? If you are a food processing plant, the answer is probably yes.