Monitoring consumption saves energy, improves output, and reduces downtime

Energy expenses can no longer be considered just a price of doing business. Power cost and quality affect cash flow, asset efficiency and profit. Fortunately, these can be controlled. You can determine your energy destiny by improving production processes and taking advantage of energy monitoring and control technologies.

In the past few years, many manufacturers — especially larger companies — have realized the need to rein in energy costs. This has become important to even more plants, including smaller manufacturers, now that rising fuel prices don’t appear to be heading back down.

Usage isn’t heading south either. According to the Department of Energy (DOE) report Annual Energy Outlook 2005 with Projections to 2025 (www.eia.doe.gov/oiaf/aeo), industrial natural gas and petroleum consumption will increase 22% and 20% respectively between 2005 and 2025, while electricity use will jump 26%.

Motor systems alone consume 63% of the electricity in the U.S. industrial sector, according to the DOE U.S. Industrial Motor Systems Market Opportunities Assessment 1998 final report. Motor systems represent the largest single electrical end use in the economy — 23% of the electricity sold in the U.S.

Often, plant managers don’t realize the savings potential sitting right at their feet. “In the distribution business, we’re always asked, ‘Can you help me get a 2%, 3% or 5% price reduction on our equipment?’ Those are peanuts compared to what we can do with the energy consumption reduction in plants,” says Steve Countryman, regional manager with Applied Industrial Technologies (www.applied.com). “Most plants have 300 to 1,500 electric motors, pumps and other equipment running, and in many cases they aren’t anywhere near as efficient as they could be.”

“Demand charges typically constitute 30% to 50% of your total energy bill,” says Phil Bomrad, director of energy services, Siemens Building Technologies (www.us.sbt.siemens.com). “If you take control and reduce your demand with demand limiting using a control system, you can have a significant impact on savings.”

Know where it goes

Energy monitoring and control systems can range from several meters to a comprehensive software setup and thousands of measuring points. Most advanced systems provide scalability, real-time data, and third-party device compatibility via protocols such as Ethernet, Modbus, Profibus, DeviceNet, LonWorks, BACnet and OPC.

Most systems use the Internet for remote access to multiple locations within a plant or between multiple locations using Web browsers on a PC or wireless devices such as a PDA or laptop. Applications include alerts and alarming, load analysis, cost allocation, bill verification, asset management, trend analysis, equipment monitoring and control, and preventive maintenance. Some vendors provide the monitoring service for the end user and offer 24/7 technical support.

Software is the key to advanced capabilities. “Modern SCADA systems are taking on more functionality, providing more user needs that keep production going and power flowing, hence providing a good ROI,” says Dr. Jay Park, international product manager, Power RICH System, ABB (www.us.abb.com). Power RICH System is a SCADA system that monitors substations and line equipment. It connects to power devices, water units, fire alarms, motors and security systems.

Microsoft.Net and XML also are making energy monitoring and control systems more useful and affordable for end users. “XML allows solution providers like us to have more flexibility with Web-based development initiatives,” says Roy Hicks, access product marketing manager, Siemens Energy & Automation (www.siemens.com). “It also provides more data management flexibility for end users.

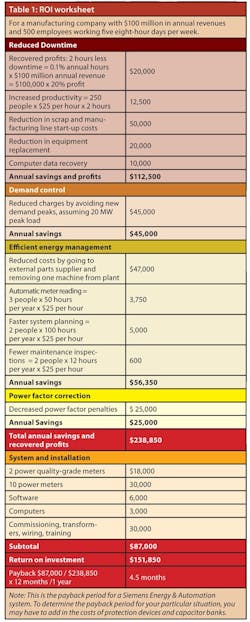

“The heart of our solution is wrapped around our WinPM.Net software,” says Hicks. “Our software is used by Access application engineers to design a system-level network that communicates and controls various models of power equipment, like UPSs, switchgear, automation and control devices, and power generation equipment such as engine generators. We can customize a user-specific application so customers can manage and control their energy system reliably in real time.” (Table 1)

Microsoft.Net and XML Web services are integrated into RSEnergyMetrix, an enterprise management software from Rockwell Automation. The software captures, analyzes and stores energy information for utilities including water, air, gas, steam and electricity across an enterprise via LAN or wide-area network (WAN).

Hyperion Wastewater Treatment in Los Angeles used RSEnergyMetrix to reduce its energy bill by $52,000 annually by discovering defects in equipment operation, reducing overall plant energy consumption, and reducing peak demand consumption and subsequent utility penalties.

Hyperion also measures potential savings from planned upgrades. In one case, engineers found they needed to order just half the number of 100-hp drives they thought would be required for a drives upgrade project, saving $220,000.

Take a bite out of costs

Implementing an energy management system typically starts with formulating an energy plan. The plan should be put in place by the people responsible for energy in the plant, such as the plant manager or “energy czar,” in cooperation with any consultants and vendors. It must be based on defined business and functional goals, such as asset optimization, energy reduction goals, cost per unit of production and/or power quality improvements.

“Once we have energy goals established working hand-in-hand with our clients, we deploy the appropriate hardware and software technologies to help the clients achieve their energy objectives,” explains Al Hamdan, marketing manager, Rockwell Automation Power & Energy Management Solutions (PEMS, www.ab.com/PEMS).

Some users install software and devices into existing monitoring and control systems, rather than starting from scratch. Park says this typically requires the ability to use many types of communications equipment, such as intelligent electronic devices, remote terminal units (RTUs) and PLCs with multiple protocols.

So just how are manufacturers getting a grip on their energy costs once the systems are in place?

Local metering reveals fair share

A food manufacturer in Williamsport, Pa., produces one of its popular snack brands in a single building within a much larger manufacturing complex. The brand was initially being charged for energy consumption based on a percentage of compound-wide energy use, and needed a better way to allocate true energy costs among the various brands and companies manufacturing within the complex. The facility manager decided to monitor and analyze power usage using E-Mon D-Mon meters and RightEnergy software from Hunt Power, L.P. (www.huntpower.com).

The manufacturer discovered that its actual energy use was less than the amount for which it was being billed. It reduced its electric bill from 11% of the overall facility electricity bill to 7%. The product line saved thousands of dollars per month in energy costs allocated to its profit and loss statement. The monitoring and control system paid for itself within 60 days.

Automatic controls trim consumption

The energy1st monitoring and control system from Stonewater Control Systems (www.stonewatercontrols.com) uses intelligent gateways installed at customer sites to collect information and push, rather than pull, information from the local devices over the Internet to Stonewater’s network operation center. It’s an integrated, real-time system that combines monitoring, alarming and device control to manage energy.

Toyota Motor Sales, U.S.A., Inc. used the system to reduce its energy consumption within its corporate and regional offices and distribution facilities. The project was coordinated by Al Pipkin, national energy and utility manager with the Facilities Services Division of Roy Jorgensen Associates, Inc. (www.royjorgensen.com).

Jorgensen started with a pilot project in six Toyota facilities, running the energy1st system for one year on seven electric meters and three gas meters. Since implementing the system, Toyota exceeded its goals of reducing energy consumption by 5% by the end of its fiscal year 2003, and by 15% by the end of fiscal year 2005.

The system is now installed at 60 U.S. Toyota facilities connecting 130 electric meters, 35 gas meters and several water meters. The automaker’s next major goal is to increase total energy efficiency by 50% by the end of 2010. “We'll accomplish this by implementing both energy efficiency measures and renewable energy projects,” Pipkin says.

Less differential pressure saves $750,000

A consumer electronics manufacturer on the East Coast started using the Delta V system from Emerson Process Management (www.emersonprocess.com) in early 2000 to control its chilled water system. The manufacturer already was using the DeltaV technology in other parts of its operations.

The water system has three 2,000-ton chillers. Four 250-hp secondary chilled water pumps were running variable-frequency drives (VFDs) to control differential pressure (DP) on loops, and they were starting to fail — smack dab during the heat of summer. This made it difficult to maintain proper differential pressure on the loops. The manufacturer installed the DeltaV system to control the chilled water system and to learn what was going on.

After making the needed changes, the loop differential pressure dropped from 20 to 6 psi. The manufacturer switched from three to two chillers, and from eight cooling towers to six. In addition, it was able to shut down two of the four secondary chilled water pumps and run the other two at 50% or less. In their hottest months (from June to September), the company cut its chilled water costs by 40% to 50%, and by even more in the winter months. Since 2000, the manufacturer has saved $750,000 on the chiller water system.

Power monitoring catches over-billing

The Foreseer system from Eaton Corp. (www.eaton.com) is scalable for one location or multinational, multi-location projects, is very fast, and communicates with many types of devices, according to Dave Loucks, solution manager. “Electricity is only part of a plant’s total energy costs, so it’s important to measure all types of devices like motors, air compressors, water chillers and even IT servers — energy density in a data center can be 100 times the energy density of any other place in a facility,” he says.

The basic version of Foreseer (called LanSafe) is free to companies already using Eaton UPSs, and a 30-day free trial is available for larger systems. A full system can range from $1,000 to $250,000, depending on many factors, and includes 24/7 monitoring at a Customer Reliability Center. A typical system cost is about $50,000.

“Part of an energy management program is having metrics like key performance indicators [KPIs] that can track your performance,” says John Van Gorp, services marketing manager with Power Measurement (www.pwrm.com). The ION EEM Web-enabled software and metering and control devices support that management framework by providing KPIs based on production.

“Energy tends to vary because it’s strongly correlated with production, so some companies are generating a KPI with a goal of benchmarking their data to measurements like per unit produced,” Van Gorp says. “Rather than looking at whether a utility bill goes up or down, their goal is to reduce energy use per unit. It makes sense.”

However, utility bills are still important. A major petrochemical company in Texas processes 340,000 barrels of oil a day and requires a substantial amount of electricity to do so. While upgrading its SCADA system to monitor the plant's electric distribution system, the plant installed the ION EEM software and meters. This generates detailed monthly energy bills to compare to those sent by the local utility.

A 10-month sampling period revealed that the utility over-billed nine times out of 10 by as much as 11%, with a cumulative deviation of 30%. The company recouped an overcharge of $120,000 on just one month's energy bill, and soon received their ROI on their $150,000 power management system investment.

Spot process problems

While power monitoring systems offer the most obvious way to track and potentially cut energy costs, process monitoring and optimization can often reveal power and productivity-wasting process problems and optimize energy consumption. “There are many ways to improve asset utilization,” says Mark Converti, senior segment manager for Power Generation Marketing, Honeywell Process Solutions (www.honeywell.com/ps). “The first thing to do is make sure your existing monitoring and control system is properly tuned, so that you save energy and extend the life of your critical plant assets.”

Another way to improve involves extending or modernizing the industrial power plant controls, and adding advanced control applications and optimization. Converti cites one typical industrial power house that purchases some electricity and also uses multiple boilers and multiple gas-fired turbine generators to produce 400,000 lbs. of steam per hour. Typical energy improvements can range from 1% to 10%, depending upon the degree of modernization and the applications selected.

“If a typical installation of advanced controls achieves a 3% improvement in energy costs, and we use a value of $4 per 1,000 cu. ft. of natural gas and $50 per MWh for purchased electricity, then you can realize a savings of just over $1 million per year,” Converti says. “Compare that to the cost of the application, which is in the range of $200,000 to $300,000. So the payback comes within a few months.”

In another example, Capitol Aggregates, Ltd.’s Capitol Cement Division, San Antonio, invested millions of dollars to upgrade one of its kiln systems to improve product yield and quality. After the project ended, however, the upstream mills couldn't process enough raw material to meet the new production capacity available from the upgraded kilns.

Capitol Cement installed advanced process control and optimization software (Figure 1) from Pavilion Technologies (www.pavtech.com) at its Finish Mill Six. The goal was to eliminate the mill bottleneck, help achieve production goals, improve product quality, and increase yield while reducing energy and operating costs.

Personnel from both Pavilion and Capitol installed the software in four weeks, and within a few weeks the plant also increased its production by more than 10%. The cement-maker also reduced specific power consumption by 4%, increased product consistency by 30%; and decreased overall operating and maintenance costs.

Power monitoring systems also can pay for themselves by spotting equipment problems earlier. For example, a motor on a chemical resin line at Chevron typically would drop out four times a year, but the chemical maker wouldn’t know it right away. While the motor was down, the resin accumulators would run dry and the resin would harden upon contact with air. It would take 24 to 36 hours to clean and purge the pipes, and that production time was lost. Chevron implemented the Power RICH system and now can get the motor into operation within five minutes of going down, saving millions of dollars and getting ROI on the power monitoring system after using it the first time.

No matter how sophisticated the system, action is critical. “We’ll give you the information in real time and give you control of energy usage, but the information is only as good as the plant’s management,” says Stonewater Control System President & CEO Randy Nogel. “Users have to match up information to whether a particular process is running efficiently. But if they don’t change how they operate, they won’t save any money.”

More to come

More automation, increased Internet use, commercial off-the-shelf (COTS) computer hardware and common software platforms will continue to make energy monitoring and control more affordable and practical.

Also, Ethernet as a monitoring, and even control, protocol will continue to increase. “Ethernet technologies are getting better and less expensive,” Hamdan predicts. “You can get Ethernet connectivity for prices as low as the serial connectivity in some cases. We see Ethernet becoming a higher visibility protocol, as we already see its use increasing. This will enable us to provide meters with more capabilities at lower price points. Consequently, this enables our customers to increase their metering points and have better energy information for analysis and control.”

Indeed, results of the ARC Advisory Group’s Industrial Ethernet Devices Market Outlook Study released in April (www.arcweb.com/res/Ethernet) indicate that the industrial Ethernet device worldwide market is expected to grow at a compounded annual growth rate of 51.4% over the next five years.

“I see a big trend in security,” adds Park. “For example, when someone comes into a facility where there’s steam or other situations where safety is a concern, motion sensors turn on a camera to monitor what they’re doing. This also plays into homeland security, such as when remote substations are vandalized. Everybody’s concerned with outsiders doing damage to their electrical and water facilities.”

In addition, power-monitoring microprocessors are being built right into devices. “The ability to meter and sensor is being pushed further down the complexity chain,” says Loucks. “We’ve always had the ability to meter a drive, but what about a 20-amp circuit breaker? No, because those are $3 devices. But what if energy monitoring were part of a $3 circuit breaker? One day it will be.”

Wireless power management is coming, but isn’t ready to join the mainstream yet. "Although wireless power management is becoming more commonplace, some environments can present unique challenges in terms of interruptions,” says Van Gorp. “For example, the technology we typically use works well where there’s some density, such as if you have an office building and a number of metering points. But for some of the largest industrial plants, we might go with a slightly different wireless technology."

“Wireless meters that are more accurate will be coming out in the not too distant future,” predicts Bomrad. “We’ll be able to say, ‘Dial-up? Nah. Ethernet? Nah. We’ll go wireless.’ We’ll install a wireless meter that will ship information back to the head-end, and it will have the best cost ramifications for a turnkey solution.” He says the accuracy is sufficient for sub-metering applications.

Honeywell Process Solutions is developing its wireless technology business, including workstations, transmitters and mobile products. “One of the greatest costs of installing a monitoring and control system is field wiring, so by using technologies such as Fieldbus to reduce field wiring, or eliminating wires altogether by using wireless technology, the better it will be for end users,” Converti says.

Another growing trend called demand response is producing opportunities for plants to reduce energy costs. “Where demand limiting lowers the amount of energy used when kW reaches a predefined level, demand response adjusts usage in response to market conditions, such as high energy prices,”

Bomrad explains. “A utility may give you a lower price if it’s cooler outside. But if it’s hot and one of their power plants goes down, the utility will raise the price, giving electricity customers the ability to ‘respond’ to that market condition. So the monitoring and control system will help plants use less energy and pay less.”

In the coming years as plants continue to modernize and look for ways to cut costs, manufacturers will need tighter controls. “The trend is toward smarter automation and optimization,” observes Converti. “The focus has changed from years ago when people were just trying to get automated. Now automation is assumed at some level, and we’re trying to get extra savings by using more advanced technology, whether through software or hardware.”

|

| Reduce water pumping energy: A large paper mill was using a 2,000-hp train engine to produce power to handle up to 20 gallons of water per minute running 24 hours per day to cool the packing in each of more than 500 pumps. “In some cases for water flush or water cooling applications, some innovative products with water-watcher type seals need less than 1/2 gallon per minute to keep the product sealed,” says Steve Countryman, regional manager, Applied Industrial Technologies (www.applied.com). “The new sealing technology doesn’t require as much cooling because of the progress manufacturers have made with the live-spindle type seals.” By installing the more-efficient seals, the mill reduced power usage on its water supply by $383,000 in just one year and was able stop using the train engine. Eliminate lip seal friction: “According to contact seal manufacturers, an average-size lip seal consumes 0.147 kW of power,” says Dave Orlowski, CEO, Inpro/Seal Co. (www.inpro-seal.com). One lip seal operating for its maximum life of 3,000 hours (4.1 months) at $0.07569 per kWh (including demand charges, state and municipal taxes and utility fees) costs $33.38 to operate. For a plant that’s operating hundreds of pumps, this can add up. “You also have the cost of replacing the lip seal and bearings and of production downtime every time you perform the replacements,” notes Orlowski. An alternative is the bearing isolator, a noncontact, nonwearing device that protects bearings in rotating equipment. It has a rotor and a stator, and the two are unitized so they don’t separate while in use. The rotor turns with a rotating shaft while the stator is pressed into a bearing housing. The two components interact to keep contamination out and lubricant in the bearing enclosure. Bearing isolators generally cost at least five times as much as common rubber lip seals. The cost of installation is about the same, and bearing isolators typically last seven to 11 years. Orlowski says bearing isolators consume no energy because they have no internal rubbing contact, are not subject to wear and generate no heat. |