The U.S. has committed to the 2015 Paris Agreement, or Paris Climate Accords, which makes commitments to achieve net zero greenhouse gas (GHG) emissions by 2050, including a 50% reduction by 2030.

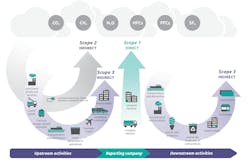

For industry, the EPA has outlined how to measure and classify GHG emissions. Scope 1 and Scope 2 emissions guidelines for GHG covers those that occur from sources that are controlled or owned by an organization and indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. However, Scope 3 emissions are the result of activities from assets not owned or controlled by the representing organization. They are referred to as value chain emissions, upstream and downstream of the organization’s activities.

EPA also provides guidance to many industrial sectors with specific process-related emissions sources under the Greenhouse Gas Reporting Program (GHGRP). The program requires GHG data reporting and other relative information for large GHG emission sources, fuel and industrial gas suppliers, and U.S. carbon dioxide injection sites. The EPA says approximately 8,000 facilities are required to report emissions annually. The data is available to the public in October each year.

In October 2021, data collected under GHGRP indicated an approximately 4% increase in emissions from large industrial sources in 2021. This reflects an increase in economic activity following the slowdown and decrease in emissions due to COVID-19 pandemic. GHGRP data has shown an overall long-term decreasing trend in industry GHG emissions since 2011.

In 2021, power plants were the largest stationary source of U.S. GHG emissions, with 1,326 facilities reporting approximately 1.6 billion metric tons of carbon dioxide emissions. Though increasing 6.4% between 2020 and 2021, power plant emissions have fallen 28.5% since 2011. Petroleum and natural gas systems were the second largest stationary source of emissions, reporting 312 million metric tons of greenhouse gas emissions, showing a 0.7% decrease in 2020, but 12.8% higher than 2016. That is the earliest year of data for this sector, as new industry segments began reporting that year. GHGRP has been collecting data for 12 years.

In March 2022, the U.S. Securities and Exchange Commission (SEC) also proposed a new climate disclosure rule, which would require companies registered with the SEC to disclose certain climate-related information in their registration statement and annual reports, including GHG emissions. The proposed rule would require companies to disclose Scope 1 and Scope 2 emissions, and some companies may be required to disclose Scope 3 emissions.

Measuring emissions reduction

“First and foremost, it takes a commitment to understand and benchmark where manufacturers are today. With that understanding, they can gain the perspective to prioritize their investments, both human and monetary, based on the desired outcome,” says Seth Harris, Emerson’s director of sustainability for the Americas.

He outlines GHG emissions guidelines for industry as follows:

Scope 1: The inherent sustainability of the energy facilities purchased to run a plant or factory’s operations. “For instance, what percent of the electricity purchased is produced by a fossil fuel power plant or a renewable power generation facility?” Harris asks. “For Scope 1, it then becomes a business decision about whom a company partners with for energy and materials. These metrics are changing supply chain expectations dramatically.”

Scope 2: The energy and waste that is a result of operations. “What is coming out of the ‘tail pipe’ of manufacturing facilities, offices, etc.? This can be measured in terms of emissions, energy efficiency, and more,” Harris adds. “For Scope 2, harnessing the creativity of people is the most powerful weapon. Conducting ‘treasure hunts’ to discover waste can be very liberating. Go into a production facility during an off shift, maybe on a Sunday afternoon or evening, and then just listen. Listen for mechanical noise, listen for the hum of motors, listen for air. All of those are energy consumers that probably aren’t performing any beneficial function.”

Scope 3: The effect products have when used by customers. “If a business makes electronics or machines used in another company’s operations, how efficient are those machines? How much energy do they consume? What is the total energy and emissions impact of those products throughout their lifecycle? Manufacturers co-own those effects along with their customers,” he asks.

Standards around the world

Global manufacturing companies span many borders, and standards also vary widely globally. IFS recently held a sustainability customer day and learned that their top three reporting standards and frameworks are: the Global Reporting Initiative (GRI), the EU’s Corporate Sustainability Reporting Directive (CSRD), and the CDP Climate Change Program. “We also see the commitment to the Science-Based Target Initiative, and their Corporate Net-Zero Standard,” says Maggie Slowik, global industry director for manufacturing, IFS. “Even if the regulatory landscape has been proliferated and somewhat vague up to this point, we are seeing developments unfolding quickly from now on.”

GRI is an independent, international organization, whose mission and history “envisions a sustainable future enabled by transparency and open dialogue about impacts. This is a future in which reporting on impacts is common practice by all organizations around the world.” GRI provides sustainability disclosure standards and creates a global common language for organizations to report their impacts.

CDP is a non-for-profit charity that runs a global disclosure system on environmental impacts for investors, companies, cities, state, and regions. Each year CDP helps others measure and manage their risks on climate change, water security, and deforestation.

The Science Based Target initiative (SBTi) is a partnership between CDP, the United Nations Global Compact, World Resource Institute, and the World Wild Fund for Nature. It drives climate action in the private sector by helping organizations set science-based emissions reduction targets. The SBTi Corporate Net-Zero Standard was released in October 2021. The standard provides guidance, criteria, and recommendations to support corporations in setting net-zero targets through the SBTi. The main objective of this standard is to provide a standardized and robust approach to set net-zero targets that are aligned with climate science.

To meet net-zero greenhouse gas emissions standards introduced in the European Green Deal by 2050, late last year, the European Union gave its final approval of the EU CSRD and is expected to start reporting on the European Sustainability Reporting Standards (ESRS) in 2024. Established in 2001, EFRAG is a private association serving European public interest in both financial and sustainability reporting. In 2022 under CSRD, EFRAG was tasked with providing the European Commission with technical advice in the form of a draft ESRS, which outlines the requirements for corporate reporting on a range of environmental, social, and governance (ESG) issues. The legislation will require more than 50,000 firms to report independently verified ESG indicators.

“Both the ESRS and the SEC will require emissions to be reported on, and as these, along with other ESG disclosure requirements, tighten up between 2023 and 2024, all manufacturers must prepare for reporting readiness,” Slowik says. “The bottom line is that whilst the topic of sustainability is not new by any means, for manufacturers it has not become an operating principle going forward. It’s no longer a question of ‘if’ but ‘when’.”

Slowik says most manufacturers are still struggling to efficiently track Scope 1, 2, and 3 emissions. This is due, in part, to an over-reliance on manual tools, such as Excel to collate data. She predicts that in the next two years, more manufacturers will make use of existing technology or invest in new technology “to help automate and ingest consistent, comparable, and reliable carbon metrics as part of their enhanced ESG disclosures.”

Measuring Scope 1 and Scope 2 emissions will be easier for organizations, Slowik says, than Scope 3 emissions. “While many companies estimate their Scope 3 emissions, going forward they will need to show improvements in their measurements by proactively forming closer partnerships with their value chain,” Slowik says. The effort will require, she says, collecting more accurate Scope 3 data.

Scope 3 emissions include 15 categories:

- Purchased good and services

- Capital goods

- Fuel-and energy-related activities

- Upstream transportation and distribution

- Waste generated in operations

- Business travel

- Employee commuting

- Upstream leased assets

- Downstream transportation and distribution

- Processing of solid products

- Use of sold products

- End-of-life treatment of sold products

- Downstream leased assets

- Franchises

- Investments.

Level the playing field

Scope 3 represents a broader view of emissions responsibility and also looks to distribute some of the burden more broadly. “It gets very interesting now to really understand those circular economies and supply chains and energy footprint,” says Peter Manos, director of research for ARC Advisory Group. He recently completed the ARC “ESG Software Emerging Market Analysis Report.” For more on the report and the sustainability software market, click here.

Eventually, with artificial intelligence and machine learning monitoring satellite imagery and other live data, “We’re going to know the emissions of every emitter,” Manos says. “So might as well act as if you’re in a glass house now.”

Scope 3 is also important for distributing the economic burden of the sustainability transition. According to a U.S. EPA report on the sources of U.S. GHG emissions in 2020, the emissions of gas and electric utilities, transportation and agriculture are responsible for close to 65% of GHG emissions (industry represents 25%). Manos says those same three industries only contribute about 5.5% of GDP value and likely can’t pay for the cost of GHG emissions reduction in the future without Scope 3 contributions. “That’s telling you how important Scope 3 is going to be. Absent of a price on carbon, there needs to be a capability in terms of regulation or in terms of what customers and venues are willing to demand or pay for. We’re all bearing the costs,” Manos says.