2017 PdM survey results: How plants are employing predictive maintenance today: Part 2

Last year you told us that, despite planned and actual investments in predictive maintenance, you were not all that happy with the results of these.

What a difference a year can make – more PdM technologies than ever are being deployed, often in targeted and complementary fashion, and your levels of satisfaction are on the way up. Even the challenges to success have shifted away from how to define expected benefits and more to whether you have enough people (and the right people) to execute effectively.

Tying PdM programs together

In one of the more discouraging findings from last year’s survey, readers indicated that their overall levels of dissatisfaction with their PdM programs had increased, despite planned modest growth in levels of PdM investment. (Three areas of investment in particular stood out as gaining since 2014: control systems, EAM/CMMS systems, and predictive analytics software.)

We are happy to report that things have changed: The overall level of satisfaction with your PdM programs has gone up by 34% since our last survey, and the share of respondents who thought that their PdM programs were “very effective” nearly tripled. Figures 5, 6, and 7 include trending data from our past three surveys, from 2014-2017, to better illustrate this rise in satisfaction and showcase the organic growth in application of PdM tools and technologies among survey respondents.

When asked which PdM technologies are being deployed, respondents indicated that the same three options that led the 2016 survey (infrared, oil analysis, and vibration) also lead this year’s survey, with each being selected by more than 70% of respondents and with infrared again the most-deployed PdM technology (at 74.8%). Two other data trends stand out: (1) the general increase in PdM technology use, and (2) the decline in reported use of predictive modeling software.

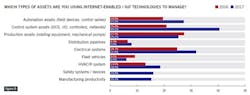

Ultrasound, electric motor testing, acoustic, and corrosion technologies registered increases in use, suggesting that plant teams are more comfortable than ever with balancing a wide suite of PdM tools and techniques in their asset management programs. This includes internet-enabled tools: Figure 8 identifies the asset types on which plant teams are using IIoT equipment – primarily automation and control assets (67.6%), electrical systems (31.8%), and rotational/mechanical assets (25.2%). Also, when asked the more-general question of whether respondents were deploying internet-enabled technologies at part of their PdM program, numbers did not change significantly over the past 12 months, with about 20% of current respondents indicating they are currently engaged, and 55.6% of respondents saying they had no plans to deploy these technologies.

It came as a surprise that predictive modeling technologies declined in reported use by 2017 survey respondents; after increasing in use by almost 50% from 2014-2016, the reported use of predictive modeling declined by about 20% over the past 12 months. This could possibly be the result of the success of other PdM approaches, where the need for predictive modeling might be reduced as teams experience greater success with PdM technologies that deliver condition monitoring data in real time.

This also may reflect the trends observed in Figure 7, which charts the stated obstacles to PdM success. Although budget constraints continue to lead all obstacles reported on the survey, several new trends are emerging. Specifically, respondents are more confident in their ability to articulate PdM financial and operational benefits (62.1% and 57.6%, respectively) than in previous years, whereas the challenges of “limited engineering resources” (67.4%) and “poor program execution” (57.6%) are starting to take their place as top-of-mind concerns. In other words, the PdM roadmaps are coming into stronger focus, but will there be enough skilled staff to deliver on the predicted promise?

Finally, the types of assets that readers tell us they are managing via PdM did not change significantly from 2014 to 2017; in general, respondents consider their production assets the top priority, followed by electrical, automation, and control systems.