2015 PdM survey results: Is your PdM program as good as it could be?

Predictive maintenance is an ever-evolving maintenance strategy, with new technologies and integration tools continually finding their way into the PdM mix. Plant Services recently conducted a new survey on this topic, asking readers how they expect their current PdM practices to change, especially given the increasing acceptance and integration of control systems into the average plant. (See our November 2014 issue for results from the first PdM survey.)

Among the most notable new findings: Seven in 10 respondents said their plant has some form of PdM program in place, although their application of PdM tools varies considerably. In addition, 40% of those who said their plant uses predictive maintenance said their PdM program “needs some improvement.” Perhaps most surprising, 17% of respondents said their plant doesn’t currently have plans to incorporate PdM tools.

“PdM programs work with the right leadership, and there are well-established precedents for success, including compelling ROI, safety, financial, and operating benefits,” says Burt Hurlock, CEO of Azima DLI. “These precedents are well-established and explain long-standing commitments by many Fortune 500 companies as well as branches of the armed services to PdM.”

Getting to know you

To get a better understanding of our readers and their PdM needs, we asked our survey responders some baseline questions. A plurality, 24 percent, identified their primary role as maintenance manager; plant engineer and plant manager, respectively, were the roles with the next-strongest responses. Less than 1 percent of readers identified themselves as IT professionals.

Most respondents said their maintenance staff numbers 50 or fewer workers. Around one-quarter (26%) said their maintenance staff consists of 11–50 people; similar shares reported a maintenance staff of 5–10 people (25%) or 2–4 people (24.5%). These rather small maintenance departments could be linked to the total number of plants that our readers’ organizations manage. Nearly 36% of readers are only managing one plant, with 29% spreading their resources across two to five plants.

Asset management and you

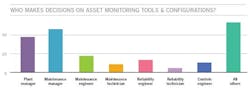

Who’s calling the PdM shots at plants? More than half of readers (57%) said maintenance managers are involved in PdM decisions; 48% said plant managers are involved. Only 21% said corporate executives are PdM decision-makers, possibly suggesting disengagement from what is happening on a daily basis on the plant floor or from the data generated through a PdM program.

When we asked readers which specific predictive maintenance technologies they have deployed at their plants, infrared, oil analysis, and vibration analysis topped the list. This isn’t surprising, given the attention these technologies have received in recent years and the high ROIs they offer.

Predictive modeling software is on readers’ radar; one-fourth of readers plan to implement it at their plants within the next three years. Acoustic technologies for predictive maintenance have a long way to go toward widespread adoption: 55% of respondents don’t plan to implement them anytime soon.

Advanced PdM features such as troubleshooting decision trees and human-machine interface (HMI) with color-coded alerts (readers’ two most widely deployed advanced features) can help plants optimize use of the data they collect, aiding them in prioritizing maintenance and repair tasks and tactics. And looking at emerging technologies, remote monitoring and analysis and analytics software generated the highest interest among readers.

In considering the motivations for implementing PdM technologies, top factors for readers included improving uptime, reducing operational costs, and reducing maintenance costs. Less-popular as drivers of PdM investments were knowledge transfer and energy management.

The current implementation of PdM programs in 70% of plants might seem like a high rate of adoption, but not everyone agrees with that assessment. “When I began in the field of condition monitoring 30 years ago, it was sometimes difficult to convince people about the need for condition monitoring,” says Jason Tranter, managing director of Mobius Institute. “But the concept of condition monitoring was not new even way back then. Therefore, I still find it a little surprising that only 70% of those surveyed are using predictive maintenance tools today. It is even more surprising that 17% have no plans to use predictive maintenance tools.”

Getting the right data

The success of a PdM program depends in large part on gathering the right data. Plant Services readers report using a variety of data-collection methods with their PdM systems. Despite the rise of automated information-gathering programs, paper-based data-collection systems so far remain the most prevalent.

This does not mean that plant professionals are uninterested in an interconnected plant. As plants strive for a more-connected environment, integration of higher-level PdM systems is becoming a growing priority. Historian systems and EAM/CMMS systems topped the list of higher-level PdM solutions that plants are implementing, with many respondents planning to integrate reliability solutions within the next three years.

Also, many respondents plan within the next three years to implement industrial-grade tablets and industrial-grade smartphones at their plant. But for others, adoption of advanced data tools looks to continue to lag well behind their arrival and proliferation in the marketplace.

Who’s reviewing the data, and how often are they doing so? In-house maintenance professionals, for the most part, according to readers, and they’re checking the data on a weekly basis. Our survey didn’t find widespread outsourcing of PdM-related tasks to third-party maintenance and repair organizations or third-party remote monitoring services.

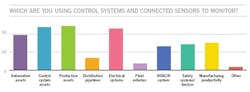

While the applications for PdM tools are vast, most plants don’t have the ability or the financial luxury to manage all of their assets with predictive technologies. Our survey found that, broadly, production assets (such as rotating equipment and mechanical pumps) were most likely to be covered through a PdM program. Control system assets, including DCS, I/O, controllers and networks, and electrical systems rounded out the top three. Very few maintenance professionals said they’re even considering implementing fleet vehicle or distribution pipeline predictive maintenance.

Control systems and assets

So, where are PdM investments going? Controls-related equipment such as controllers, networks and software is most prevalent among PdM tools, with predictive maintenance technologies for condition monitoring (including thermography, oil analysis, vibration, ultrasound and motor testing) ranking as the next-most-popular investments.

Smart (i.e., self-diagnostic) instrumentation and specialized control systems are catching on with readers, as slightly more than half of respondents indicated that they are already using these technologies to monitor assets.

Interestingly, the adoption rate for these technologies is projected to slow, with readers expecting to make deeper investments over the next three years in embedded remote monitoring devices and automated work-order generation, including repair history, diagnostics, and procedures and parts information. For all of these technologies, about 30% of readers indicated that they have no plans at all to implement them.

When it comes to how readers are using control systems and connected sensors to monitor plant assets, the top four applications were no surprise: production assets, control system assets, electrical systems, and automation assets. These are the mission-critical systems and assets against which downtime and OpEx costs are measured, and readers clearly are open to using the latest in smart/control technologies to maximize asset productivity.

Looking to the future

A plurality of survey respondents said their plants plan to increase spending on control systems, production assets and instrumentation by up to 5%. Few readers anticipate seeing an increase in PdM investments greater than 5%, but of more importance, very few anticipate trimming investments in their PdM programs.

Wringing the most value from a PdM program is not a short-term challenge. “PdM does require investment and ever scarcer expertise,” says Azima DLI’s Hurlock. “It also requires performance tracking: knowing unplanned maintenance and CapEx spending and the incidence of unplanned downtime. If companies don’t track spending and performance, they can’t measure or realize the effects of PdM.”

When asked to reveal the obstacles limiting the success of their PdM initiatives, budget constraints and undefined financial benefits ranked highest. “It is clear that the financial benefit of condition-based maintenance is still not widely understood,” says Jason Tranter.

“Lack of executive support and budget constraints often flow from a lack of understanding or belief in the financial benefits of condition-based maintenance. That situation often exists because there is a lack of agreement on how to quantify the benefits of detecting a failure before it occurs. This is one reason why benchmarking and tracking KPIs is so important, along with active communication.”

Timothy Dunton, a director and instructor and developer of Reliable Manufacturing at Reliability Solutions Training, says that old-school thinking at smaller plants may be stalling more-widespread adoption of PdM tools and practices. “You can get into the game quite inexpensively with the right approach,” Dunton says. “It would seem that we have done a poor job of demonstrating the value of lower-cost tools.”

But without adequate resources (whether internal or external) to help implement PdM tools, those advocating at smaller plants for adoption of PdM strategies may find themselves stuck between a rock and a hard place. Azima DLI’s Hurlock comments, “What right-minded organization invests in anything without defining financial and operating benefits, and without executive support and the IT and engineering resources required to sustain the program? ... If benefits and objectives can’t be defined and resources and support aren’t available, PdM is a waste of time and money.”

Survey respondents clearly see room for improvement in their plants’ own PdM programs. Forty percent of those whose facilities have deployed PdM tools said that their PdM programs need improvement. Only 25% rated their plant’s PdM program as satisfactory.

“It is unfortunate to see that only 4% of people feel that their PdM program is ‘very effective,’ ” says Mobius Institute’s Tranter, reviewing the survey results. Tranter added that he believes the low share of “satisfactory” ratings “relates to the fact that most PdM technicians are not adequately trained on the technologies, and when they do provide recommendations, they are often too technical and vague.” Most users of PdM tools need “clear, unambiguous, actionable information,” he says.

In addition, Tranter says, if there’s not widespread buy-in within an organization into the philosophy of condition-based maintenance, then reactive or preventative maintenance strategies will dominate.

Reliability Solutions Training’s Dunton sees reason for predictive maintenance champions to take heart. Among plants that have begun to incorporate PdM tools, “there is an awakening that (PdM programs) have more to offer,” he says. That’s one way to look at the large share of survey respondents saying that their plant’s PdM program could use improvement, he offers: They recognize that PdM has potential that’s not yet being realized.

“For that to happen,” he says, “analysts will need more time, and for that to happen either the (user) groups will have to grow, or we leverage technology to eliminate the more mundane aspects of the process. Lower-cost technology, simpler technology, might enable more people to be involved.”