2021 COVID-19 impact survey: What's changed for maintenance and what's stayed the same

What a difference a year makes.

At this time last year, many people were under shelter-in-place orders to help prevent the spread of the novel coronavirus. Health and safety protocols for essential workers changed virtually overnight, and plant shutdowns were common. Maintenance workers who knew their way around a thermal camera suddenly were finding themselves stationed at plant entrances, taking the temperature of arriving workers.

Now, as of early April, more than 40% of the eligible population 16 and older in the U.S. has received at least one dose of a COVID-19 vaccine. And, while factory employment is 4% below pre-pandemic levels, manufacturing activity in the U.S. has just hit its highest level in 37 years. Some reports indicate that activity levels could have been higher, but the search continues for qualified workers to fill open skilled positions.

At the start of this year, the Plant Services editors decided to take one final look back at the pandemic year, and take a snapshot of the new normal that is emerging from this moment of crisis. Our first survey on this topic captured a slice of time during the middle of the crisis (http://plnt.sv/COVID-2020). This new survey was conducted in February and March 2021, and generated more than 140 responses.

We thank everyone who took the time to share their thoughts via the survey, and are pleased to share the results with you from then and now. With any luck, the worst of the hiccups from the pandemic are behind us, and they are rapidly being absorbed by industry as simply a set of new best practices.

1. Operational changes

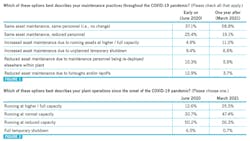

Taken together, the two charts in Figures 1 and 2 tell a tale of recovery in the manufacturing sector. Last June, plants were in the middle of making tough choices about how to best deploy their personnel, and how many people they could afford to keep.

Only about 1 in 3 respondents could say that there were no changes to their regular asset maintenance workload and headcount, and 13% of respondents admitted that they were reducing available maintenance resources due to furloughs and/or layoffs. To make matters worse, fully half of respondents last June said their plants were running at reduced capacity, and 6.5% said they were experiencing a full temporary shutdown.

Again, what a difference a year makes. More than 25% of respondents claim they are currently operating at higher / full capacity, and only one person said they were still under a full shutdown. On the maintenance side, nearly 3 in 5 respondents can now say they are back to their pre-COVID maintenance and headcount levels, and 11% are reporting increased asset maintenance due to running assets at higher or full capacity.

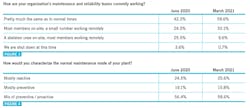

2. Changes in maintenance modes

For the survey questions that took a deeper dive into maintenance practices then and now, a similar picture emerges. Nearly 3 in 5 respondents tell us they are now back to running pretty much the same as they were in pre-COVID days (see Figure 3), and maintenance modes are trending slightly away from preventive, with a slight rise reported for both reactive and more proactive modes (Figure 4).

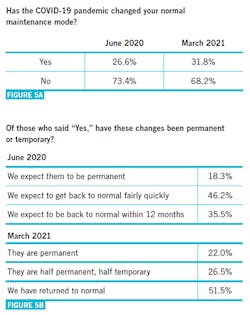

These results suggest that disruptions caused by the pandemic provided many maintenance teams with the opportunity to change their practices, with 26% of respondents noting this opportunity last June, and 32% of respondents admitting in March that changes had taken place (see Figure 5). It’s also interesting to note that a year ago, nearly half of respondents thought we’d get back to normal fairly quickly. Now, with 12 months of hindsight, just over half of respondents say that it has taken a year to return to normal.

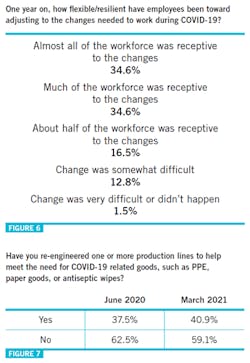

3. Plant agility

The questions in this section were a mixed bag, designed to evaluate the level of flexibility among plant teams during the pandemic, from operations to professional development. Figure 6 uncovered a very high level of resilience among plant workers, as 7 in 10 respondents said that most or all of their teammates were receptive to necessary changes in routine and production. And the data in Figure 7 make it clear that more than 40% of respondents were actively re-engineering production lines to meet the immediate needs of the market during the height of the pandemic.

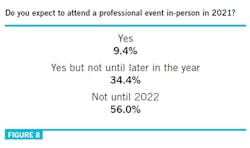

Finally, Figure 8 asked about the next time people would be able to travel and see each other again at professional events. It may be a while before we all are able to see each other again at an event, but I’m thrilled to note that almost half of you are looking forward to attending at least one event before the end of 2021.

4. Pressing needs

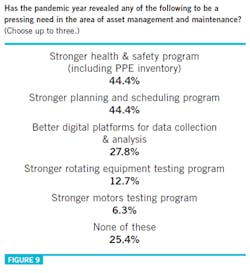

The final questions on the survey asked about the needs that the COVID-19 pandemic had revealed, both in the areas of asset management and in human resources. In my opinion, these data point to the most revealing change of the pandemic: the change away from seeking out full-time proactive maintenance experts, and toward building stronger partnerships with service providers.

Starting with the data in Figure 9, it was interesting that, when it comes to needs in the area of asset management, the data points barely moved between June 2020 and March 2021. A vast majority of respondents indicated that they needed both a stronger health and safety program and a stronger planning and scheduling program.

The question in Figure 5 asked if your maintenance mode had changed in the past year, and nearly 1 in 3 respondents said yes. This is a sampling of the ways people told us they changed up their maintenance modes:

- Getting more reactive due to personnel constraints

- More time sanitizing

- Went to A/B shifts to gain redundancy

- Lagging scheduled maintenance due to staff reductions and moving toward more reactive

- Increased preventative tasks, executed overhauls of special equipment

- We have installed new tech to be able to communicate with staff at home or abroad

- Specialty janitorial activities, PPE usage mandatory, reduced visitors access

- Doing more PdM, holding more critical spares

- Getting more preventive and with more careful planning to keep maintenance crews separated from each other and from operations personnel

- Shortage of manpower so mostly PdM maintenance job suffers to tackle reactive maintenance job

- This pandemic has changed how we dress, how we clean, how we work, where we work, what we report and almost every aspect of our working world. Prevention, maintenance, and corrective action are ever present in a way we’ve never seen. How much do you change when the hazard is AIR?

- Longer shutdowns to reduce crowding

- We have become more reactive and less proactive due to the loss of personnel

- Getting more reactive; maintenance force hasn’t changed, but not expanding along with demand

- Increased focus on employee safety, reduced time available for other projects

- Some reactive, with just a little proactive maintenance work

- Loss of tribal knowledge with union members moving to alternate jobs; more off-site support from retired engineers working exclusively off-site; indicators point to a maintenance crisis in 12 to 18 months as ignored equipment moves down P-F curve

- Running equipment to failure then fixing the problem

- Most of the reactive maintenance has turned into proactive

- More reactive, because some staff were working from home, and there was uncertainty as to who might get infected

- Split shifts across all production departments to reduce exposure risks

- Pausing every program

- More reactive, split crews to reduce exposure and many exposures and COVID absences

- Data collection reading gauges and by portable testers more automated to eliminate external contractors and reduce personnel in a plant; as a result, also more predictive

However, it is the data in Figure 10 that point to a new post-crisis emphasis on bringing contractors on-board to help fill maintenance resourcing gaps. This trend matches what the Plant Services editors have observed in general when it comes to how organizations are overcoming the industrial skills gap. Taken in the immediate context of other data from this survey, it also seems clear that renewed levels of production are also driving plant teams to fill headcount needs quickly.

Bringing contractors on-board also leaves plants with room to maneuver if production levels change again quickly. After all, thanks to COVID-19, we all have a new appreciation for how rapidly drastic change can be forced upon us.

When asked if you and your teams had filled any of the technology needs listed in Figure 9 over the past year, nearly 3 in 10 respondents said yes. This is a sampling of tools and technologies that you adopted:

- Ultrasonic leak detection

- Microsoft Teams video meetings

- Stronger preventative policy

- Upped our safety and PPE programs

- Safety, PPE, social distancing, plexiglass separation on lines, mostly focused on COVID prevention to maintain operations

- Tablets for technicians

- Planning and scheduling is completed online, from the meeting to an online shared planning sheet that can be updated and viewed by a number of people

- Implemented machine monitoring equipment and software

- We have new hardhat installed Microsoft Teams with screens and cameras

- Digital data collection and 24/7 electronic visibility of production

- RCFA, vibration analysis through remote monitoring

- Planning/scheduling: More formal process, request specific amount of time and when for corrective.

- Implemented a planner/scheduler program, reducing spare parts inventory

- More online vibration monitoring and data exporting to advanced pattern recognition software for proactive analysis

- We are currently using GotSafety, Zurich, and our insurance broker’s technologies to create a comprehensive safety program that includes the COVID problem and all it entails

- Planners hired

- Virtual safety training via VPN

- Used spreadsheets / Teams meetings to manage PPE, cleaning supplies, etc., across multiple sites

- Young engineers assigned to remedial task forces, but, they don’t know what they don’t know

- Stronger health & safety programs

- Planning of main turnaround, revised planning

- Digital data platforms working for large numbers simultaneously

- Temperature monitoring at all entrances, daily COVID protocol via text/email

- More reliance upon digital communication and enhanced PPE use

- Developing in-house vibration analysis competencies

- A PdMA tester is being purchased, and planning and scheduling is being pressed to try to break the reactive maintenance cycle; additional PT&I resources have been purchased and are being implemented

- Moving asset management database to cloud

- Digital platform for data collection and analysis

- Wireless vibration, corrosion, and leak/passing detection to replace mechanical instrumentation